Why you need to vote YES!

The current sales tax (0.5%) supporting Doctors Memorial Hospital was instituted in January of 2021 and expires December of 2026

Sales Tax revenue can only be used for repaying debt associated with the construction of the hospital (built in 2007/2008). The hospital pays $1.2million in bond payments per year until November 2038. Sales Tax revenue for 2023 was $942,863.

Renewal of a half percent sales tax supporting Doctors Memorial Hospital will be on the ballot in November 2024.

Voting yes ensures the hospital will continue to be supported from January 2027 through December 2032 (6 years)

Holmes County has large non-insured and under-insured populations that depend on the hospital for medical care. It costs the hospital approximately $2.6million to provide uncompensated care annually.

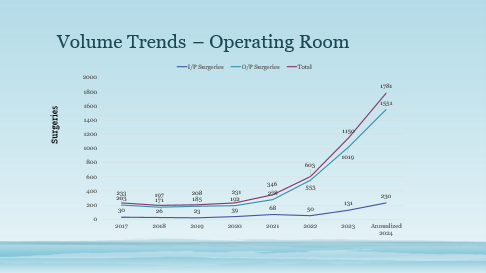

Doctors Memorial Hospital is growing!

Demand for Doctors Memorial Hospital services has grown considerably over the last 5 years. Emergency room, outpatient diagnostics, inpatient services and operating room volumes have all experienced tremendous growth.

Bringing Doctors to Holmes County

Doctors Memorial Hospital has considerably grown the medical staff with additional clinic providers, ER providers, Hospitalists, ENT, Pathology, Orthopedics and Sports Medicine doctors.

Committed to the underserved

Doctors Memorial Hospital is reaching out to the underserved regions of Holmes County to provide primary care with a Mobile clinic. Communities include: Esto, Ponce De Leon and Westville. These services are provided Monday through Thursday.

Doctors Memorial hospital is non-profit

Doctors Memorial Hospital is not beholden to investors, nor motivated only by profit. We pride ourselves on making the very best decisions for our patients first and foremost. In most for-profit institutions, corporate decides how doctors practice medicine and the patient becomes a number. We like to think that we treat patients better – that this is how medicine is supposed to be practiced – and doctors want to work here because they see the difference.

Being non-profit, our staff appreciate that they also are not treated like a number. We recognize that the employees are the core of our institution and are our most valuable resource. Doctors Memorial Hospital has been able to hire great employees who once worked at for-profit hospitals and who believe in the mission of our hospital. Our employee retention rate is evidence that ‘who we are’ and ‘what we do’ are good and worth investing our employees time and effort.

Frequently asked questions

Why is this tax needed again?

Annually the debt repayment is 1.2M. The $1million collected annually through the tax is essential to ensure the hospital is able to repay the debt associated with building our current facility while still providing medical care to Holmes County

Why are you asking for it early?

If the hospital were to do the referendum in 2025, it would cost tens of thousands of dollars for the special referendum. If the hospital were to wait until 2026, the hospital would be unable to complete the budget for 2026-2027 as the new financial year would be commenced prior to knowing whether sales tax funds would be a part of the hospitals non-operating revenue.

How has the current sales tax money been spent?

ALL of the tax money received has been placed in an account from which only bond payments are drawn.

How much money has the hospital received through the surtax?

- 2023: 942,863

- 2022: 913,860

- 2021: 532,077 This was the first year that sales tax funds were appropriated to DMH beginning in January with was 4 months into the financial year

When will the bond debt be completely paid off

2038

Who are the bondholders?

Wells Fargo and Lord Abbott.

Is there federal or state money that can pay off the debt?

It is unpopular to pay off existing debt in government circles and such funding has not been found.

What is the cost of uncompensated care provided by DMH?

$2.6M / year

(850) 547-8000

(850) 547-8000